by Optima Financial Group | Sep 18, 2013 | Taxes & Your Savings

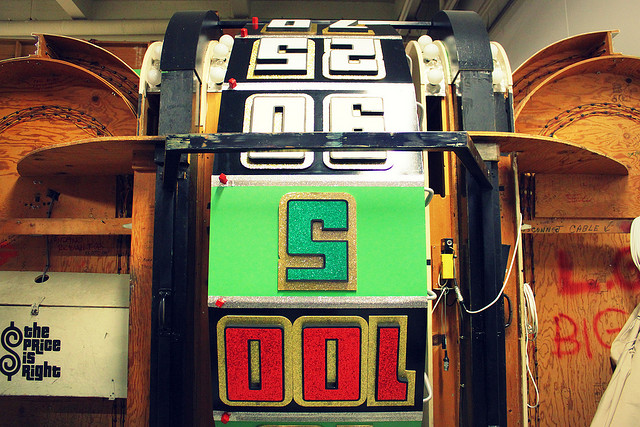

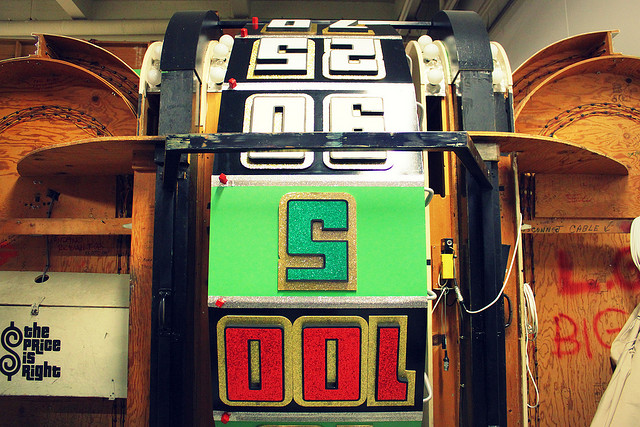

Before you envy those game show contestants who win big, you need to hear the rest of the story. Some winners scoop up prizes worth tens of thousands of dollars, and maybe even a car. But often they don’t realize that those items are taxable. Depending on the details, they may not be able to leave the show with their prizes until part of those taxes are paid.

One contestant, Andrea Schwartz won $33,000 worth of prizes on The Price is Right (TPIR), including a pool table, a shuffleboard table, and a shiny new red Mazda 2. After the show she was whisked backstage to do the paperwork, and come up with the tax.

In an interview with Yahoo!Shine, she told reporters, “Yeah, you don’t just drive off the back lot with the car. After the show, you fill out some paperwork and basically sign your life away. You say that you’re going to pay the taxes on it. If you win in California, you have to actually pay the California state income tax ahead of time.”

Of course, winners will also have to file their regular tax returns during filing season, and the value of the items will be added to their taxable income. By the way, the value you are taxed on is the manufacturer’s suggested retail price, which may be considerably higher than you could buy it for yourself. This could push you into a higher marginal tax bracket.

Pay the Piper or Leave the Prizes

For Schwartz, winning at TPIR meant paying $2,500 on the spot. Fortunately she had also won $1,200 cash playing Plinko on the show, so while that helped, she had not envisioned spending it to pay taxes.

According to the AICPA, Schwartz and anyone who wins and pays state income tax as she did, will be able to claim a tax credit in his or her home state for the taxes paid in the state where the win occurred.

A common question contestants ask is, can they take the value of the prize in cash? According to another TPIR winner, the answer is, not usually unless the prize is not immediately available. Then you might be offered the cash value if you choose not to wait. This winner said on Consumerist.com he won prizes worth $57,000 and owed taxes of between $17,000 and $20,000.

Consumerist.com affirmed that many winners end up declining their prizes because of the tax or other issues. For example, TPIR will only ship prizes to your home address. If you want items shipped elsewhere you have to pay extra. Schwartz lives in an apartment and could not receive the two large tables at her residence. In the end, she sold them on Craigslist for less than one-third the value.

Long Story Short…

Winning is great, but game show prizes generally come with hefty costs. And sometimes the tax has to be paid immediately or you forfeit the prize. Before you go on that game show or enter a contest, find out what the tax implications are so you don’t end up regretting your big win.

Photo: stweedy

by Optima Financial Group | Sep 11, 2013 | Tax Planning

Football season just kicked off and fans are keenly aware that the players out there are raking in more money in one season than most people will make in a lifetime. New Orleans Saints quarterback, Drew Brees for instance, is averaging $20 million a year. Most team members don’t make anywhere near that, but rest assured they are well paid.

Big Bucks Big Taxes

NFL players also have enormous out-of-pocket expenses. Naturally they can write off all the usual items as long as they qualify. But what else can they deduct?

- Agent fees, which are generally a percentage of a player’s income. These max out at 3% but for other income such as endorsements the fees are higher.

- Ground transportation costs (taxis, parking fees, and tolls) related to away-games, training, meeting with agents, scouts, trainers, etc.

- Fines for acts which do not violate public law.

“I am often asked if player fines are deductible,” said CPA Robert A. Raiola. “For example a fine for speeding is not deductible but a fine for being late to practice is deductible because it violates team policy, but not public law.” Many people believe fines are deductible because some leagues, including the NFL, donate this money to charity. “That’s a common misconception. Whether the fines are donated or not, they are deductible to the athletes,” said Raiola. Raiola is head of the Sports & Entertainment Group for the New Jersey-based accounting firm of Fazio, Mannuzza, Roche, Tankel, LaPilusa, LLC.

Additional expenses include:

- Athletic equipment related to his sport. Also deductible are training classes and general workout equipment classes which are part of his overall athletic development.

- Therapeutic massages may be deductible.

- Reasonable costs of chiropractic care and body maintenance fees, during the season.

- Temporary housing, for a definite time period, such as for rehab after an injury.

- Rookie expenses.

Rookies are generally expected to take the team or a position group out for meals at times. It’s considered a normal business expense in the NFL, and generally it is deductible, subject to the standard 50% meals and entertainment limit.

The Lesson?

The deductions are out there, but it takes the expertise of a trained professional to get the best tax results. That’s true for anyone who receives a large sum of money from any source, such as a lottery win, a legal settlement, an inheritance, life insurance, a gift. You’ve heard the stories of people who were suddenly rich, rolling in money. A few years later they are flatbroke, bankrupt, in tax debt, and with no idea how it happened.

The problem was, they had money coming out their ears, but what they didn’t have was the financial sophistication to handle the money well, guard their assets, and minimize the tax bill. For anyone who gets a large sum of money from any source, the first dollar spent should be to get a good financial professional on your side. It’ll be worth the cost.

Photo: Matt McGee

by Optima Financial Group | Mar 20, 2013 | Retirement

This post originally appeared on The Fiscal Times.

When you leave the workforce and give up a paycheck, life seems grand – endless free time, no more alarm clocks, and lower tax rates – or so it seems at first. Even if you’re raking in over a million dollars in retirement savings a year, you won’t have to pay Social Security and Medicare taxes, and some states don’t tax such income either.

But those tax savings won’t get you very far. As you start drawing Social Security checks and supplement them with tax-deferred retirement plan withdrawals and investment income, your taxable income can go up sharply. What really matters is not how much you have in retirement accounts, but what you’re left with after taxes.

Planning your income in retirement – and reducing your overall tax bill – is critical to making your money last. Here are eight ways to manage your tax bite after you leave the workforce.

1. Strategically withdraw from your IRA.

Rules on tax-deferred retirement plans like IRAs, 401(k)s, and 403(b)s allow you to take distributions starting at age 59.5, and you must start withdrawing the required minimum by age 70.5 or face stiff penalty fees. It’s usually better to pull money out when your taxable income for the year will be lower, especially when the total stays under the 25-percent tax bracket (which starts at $36,250 for singles and $72,500 for married filing jointly in 2013), says William Reichenstein, investment management chair at Baylor University.

Being strategic means you’ll pay the 10- or 15-percent rate on those withdrawals. You might take out tax-deferred money, for example, in a year when you have a lot of deductions – when you’re paying high medical expenses, for example, or are making a large charitable contribution, which would significantly reduce your taxable income. For example, you might have one year when your income from a pension is $40,000, but you have medical expenses of $20,000; this would be an excellent time to withdraw from an IRA. If you know you’ll exceed $36,250 (or $72,500 for married couples), it’s best to stay under the next tax bracket. Find the 2013 tax bracket rates here.

2. Pay estimated taxes on your Social Security benefits.

Social Security income is taxable, depending on the amount of your “combined income,” which the government defines as your adjusted gross income, plus any non-taxable interest (interest earned on tax-free municipal bonds, for example), plus 50 percent of your Social Security benefits. For an individual, if your combined income is between $25,000 and $34,000, you’ll pay normal income tax rates on up to 50 percent of your benefits; if it’s more than $34,000, you’ll pay tax on up to 85 percent. Mark Steber, chief tax officer at Jackson Hewitt Tax Service, says you can request that the Social Security Administration withhold those taxes from your checks, but it’s better to make estimated payments yourself because it’s common for combined income to fluctuate a lot, and the amount withheld would likely be too high or low.

3. Consider delaying your Social Security checks.

One benefit of waiting to collect Social Security until you’re older is that your checks will be larger. Though you can start collecting any time between the ages of 62 and 70, for every year you wait, your check will grow by roughly 6.25 percent, says Philadelphia-area financial planner Daniel White of Daniel White & Associates. But taxes also play into it.

In a paper last April for the Journal of Financial Planning, Baylor’s Reichenstein and a coauthor tested the effects of starting Social Security at different ages. They found that someone who retired in 2011 at age 62 with $700,000 in savings and started taking monthly Social Security checks of $1,125 that year would exhaust their portfolio in 30 years at a given spending level. But if they used their own assets to fund their early retirement and started taking their now-much-larger checks of $1,980 at age 70, their portfolio would last at least 40 years at that same spending level. This is in part because only 50 percent of your Social Security benefits count toward the combined-income threshold. Of course, all decisions like this are a gamble — if you die young, it would have been better to start taking Social Security earlier. However, if you have a surviving spouse, he or she would receive all or part of your benefit, depending on their age.

4. Give your children appreciated assets instead of cash.

If you’re planning to give money to the children or grandchildren, one way to do so while getting a tax benefit is instead of cash, give them a stock that’s grown since you bought it, says White. Of course, your family member will pay the capital gains tax when they sell the asset, so for both of you to benefit, the recipient should be in a lower tax bracket than you are – which is likely if you’re helping them out.

5. Convert your IRA to a Roth IRA.

If you can afford to pay the taxes, start converting your IRA to a Roth IRA, says Matthew Curfman, certified financial planner at Richmond Brothers in Jackson, Michigan. Growing your money in a Roth and then being able to withdraw it tax free will protect you against future tax increases. Also, since there’s no mandatory withdrawal on a Roth, it makes an excellent long-term contingency fund – and any withdrawals don’t count in the combined-income formula used to tax Social Security benefits, notes David Littell, co-director of the American College of Financial Services’ Center for Retirement Income.

6. Make charitable contributions from your IRA.

The New Year’s Day fiscal cliff deal resuscitated an expired provision for 2013 that allows people age 70.5 or older to donate up to $100,000 from their IRA to a qualified charity, without having to pay taxes on the transfer. That donation can help satisfy your required minimal distribution. You can’t beat that provision, Curfman says. If you donate $20,000 from your IRA to the charity, the nonprofit gets all of it. But if you withdraw $20,000 out of your IRA and then donate the cash, the IRS taxes it before you make the donation – so if the tax was $3,000, the charity gets only $17,000.

7. Raise the cost basis of your investments when your income is lower.

Low-income years in retirement are a great time to sell a stock that has appreciated and reinvest the gain in stock of a similar class, says Reichenstein. That’s because, under the fiscal cliff deal, the long-term capital gains rate is zero (yes, zero) on people whose income puts them in the 15-percent bracket or lower (up to $36,250 for a single filer and $72,500 for married filing jointly).

In years when you’re in one of those brackets, you can sell a stock you bought originally at $40,000 that’s now worth $50,000 and buy another stock worth $50,000. You’ve raised the cost basis of the stock by $10,000, reducing the taxes you’ll pay if you have to sell it in a year when you’re in the 25-percent or higher bracket. Use caution though, says Reichenstein: Make sure that $10,000 in gain doesn’t push your income for the year high enough that it would cause your combined income to rise to the point that your Social Security benefits are taxed at a higher rate.

8. Move to a tax-friendly state.

If you’re moving for retirement, consider taxes as part of your decision, says Diana Webb, assistant professor of finance at Northwood University. A report last September from Kiplinger identified Alaska, Nevada, and Wyoming as the three states with the most retirement-friendly tax laws. The worst include Ohio, California and New York.

by Optima Financial Group | Mar 14, 2013 | Tax Planning

| A tax credit reduces the amount of tax you must pay. A refundable tax credit not only reduces the federal tax you owe, but also could result in a refund.

Here are five credits the IRS wants you to consider before filing your 2012 federal income tax return:

1. The Earned Income Tax Credit is a refundable credit for people who work and don’t earn a lot of money. The maximum credit for 2012 returns is $5,891 for workers with three or more children. Eligibility is determined based on earnings, filing status and eligible children. Workers without children may be eligible for a smaller credit. If you worked and earned less than $50,270, use the EITC Assistant tool on IRS.gov to see if you qualify. For more information, see Publication 596, Earned Income Credit.

2. The Child and Dependent Care Credit is for expenses you paid for the care of your qualifying children under age 13, or for a disabled spouse or dependent. The care must enable you to work or look for work. For more information, see Publication 503, Child and Dependent Care Expenses.

3. The Child Tax Credit may apply to you if you have a qualifying child under age 17. The credit may help reduce your federal income tax by up to $1,000 for each qualifying child you claim on your return. You may be required to file the new Schedule 8812, Child Tax Credit, with your tax return to claim the credit. See Publication 972, Child Tax Credit, for more information.

4. The Retirement Savings Contributions Credit (Saver’s Credit) helps low-to-moderate income workers save for retirement. You may qualify if your income is below a certain limit and you contribute to an IRA or a retirement plan at work. The credit is in addition to any other tax savings that apply to retirement plans. For more information, see Publication 590, Individual Retirement Arrangements (IRAs).

5. The American Opportunity Tax Credit helps offset some of the costs that you pay for higher education. The AOTC applies to the first four years of post-secondary education. The maximum credit is $2,500 per eligible student. Forty percent of the credit, up to $1,000, is refundable. You must file Form 8863, Education Credits, to claim it if you qualify. For more information, see Publication 970, Tax Benefits for Education.

Make sure you qualify before claiming any tax credit. You can always visit IRS.gov to learn about the rules. The free IRS publications mentioned are also available on IRS.gov or by calling 800-TAX-FORM (800-829-3676).

Additional IRS Resources:

|

The post Five Tax Credits that Can Reduce Your Taxes appeared first on SuperMoney!.

by Optima Financial Group | Jan 31, 2013 | Tax Planning

You may have done the hard work to find your deductions and credits, choose your filing status, and even itemize, but it’s all for naught if you don’t file your tax return!

Thanks to technology, filing your return is getting easier and easier. But there are still some nuances to know. Find out which way you should file—electronically or by mail—and how to do it.

Electronic or Paper Filing?

E-filing is the preferred way to file, because it is faster, more convenient and more secure than paper filing.

Think about it: If you e-file, all your information is automatically entered into the system, while a paper return has to be retyped by an IRS employee, which introduces more opportunity for errors. If you e-file, you’ll get confirmation within 48 hours that your return was received. You can get your refund (if you have one) deposited directly to your account more quickly, typically in as few as ten days. For e-file users, you also have more payment options, including setting up an automatic payment withdrawal date for any day before the April due date. You can also pay by paper check or even by credit card!

However, there are some instances where you are not able to file an electronic return. You must paper file if:

- You’re married, but filing a separate return, and you live in a community property state

- You are claiming a dependent who has already been claimed by someone else

- You are filing forms that require paper documentation. For example, the first-time homebuyer credit requires paper filing

- You file before e-filing begins (it started on January 30th this year) or after it ends (October)

How to File an Electronic Return

There are several ways to file electronically:

If you’re paying a tax professional to prepare your return, they will e-file for you. Many are required by law to e-file, but still make sure to mention it to them so you get your refund faster.

If you are using commercial tax software, e-filing is included. Just submit through the software when you are done. Incidentally, e-filing is including in the discount TaxACT package every participant in our Ace Your Taxes Bootcamp receives.

If you’re preparing your own return, you can file for free. Those who have an AGI under $57,000 can use what the IRS calls Free File. If your AGI is over $57,000, you can use fillable forms, which are electronic versions of the IRS’s paper forms and are still free.

How to File a Paper Return

If you need to file a paper form, or just prefer paper forms and don’t mind the longer wait for your refund, you can do it the old-fashioned way. The IRS will not mail you your forms ahead of time like they used to, so first you’ll need to pick and download your forms. Find out which ones you need.

When you’re ready to send in your return, make sure your name and Social Security Number are on the front and back of every page. Make a photocopy of your return for your records. Then, check the IRS for where to send your return, according to which state you live in.

We recommend you send your return by registered or certified mail. You will be able to track its progress and see that it was delivered. Make sure the registered date is on or before April 15, 2013, this year’s filing date.

You can also send by private delivery service. Use an IRS-approved one such as DHL, FedEx or UPS, but beware that private delivery services cannot mail to post office boxes, so you must use the addresses in this list. Whichever mailing service you use, save your receipt.

by Optima Financial Group | Dec 20, 2012 | Tax Relief Solutions

Earlier this year, the Internal Revenue Service (IRS) rolled out its Fresh Start Initiative, aimed at helping struggling taxpayers. The initiative allows qualified taxpayers to avoid the IRS Failure to File penalty. This penalty is usually placed on unpaid tax balances, with accrued interest. Qualified individuals can request a six-month payment extension in which no penalties will accrue. Late payment penalties will be charged if the balance is not paid by October 15. Secondly, Fresh Start provides a different installment structure, allowing taxpayers to avoid financial reviews and Federal liens.

Recognizing the need for tax relief, IRS Commissioner Doug Shulman said, “This new approach makes sense for taxpayers and for the nation’s tax system, and it’s part of a wider effort we have underway to help struggling taxpayers.” Do I Qualify for the IRS Fresh Start Initiative? is the logical question being asked by many taxpayers. Consider the qualifications below.

- You must have been unemployed for a minimum of 30 consecutive days during 2011 or before April 15 2012.

- Married couples filing jointly need to have only one spouse that meets the qualifications.

- Individuals who are self-employed need to be able to show at least a 25 percent drop in their net income.

- Taxpayers must not earn more than $200,000 per year for married couples or $100,000 per year for individuals.

- Fresh Start is also limited to taxpayers whose tax balance was not more than $50,000 at the end of 2011.

- Taxpayers must file Form 1127A, which is not available electronically.

by Optima Financial Group | Dec 11, 2012 | Tax Planning

How do you know if you need a tax attorney?

Tax attorneys are lawyers who specialize in the complex and technical field of tax law. According to this article from about.com, you definitely need a tax attorney if:

- You have a taxable estate, need to make complex estate planning strategies, or need to file an estate tax return.

- You are starting a business and need legal counsel about the structure and tax treatment of your company.

- You are engaging in international business and need help with contracts, tax treatment, and other legal matters.

- You plan to bring a suit against the IRS.

- You plan to seek independent review of your case before the US Tax Court.

- You are under criminal investigation by the IRS.

- You have committed tax fraud (such as claiming false deductions and credits) and need the protection of privilege.

But what if you’re already mired in tax debt and can’t afford to hire an attorney? Low Income Taxpayer Clinics (LITCs) represent low income taxpayers before the IRS and assist taxpayers in audits, appeals and collection disputes. These clinics, which are operated by nonprofit organizations or academic institutions, can also help taxpayers respond to IRS notices and correct account problems.

Another option is to seek assistance from a referral system operated by a state bar association, a state or local society of accountants or enrolled agents, or another nonprofit tax professional organization.

Debt settlement companies are not law firms and cannot provide legal advice. However, debt settlement can be a part of your solution to tax debt. Debt settlement means that your debt is negotiated down to a reduced amount and paid off in a lump sum. Settlement is a good choice if you have more debt than you can pay off within two to three years or are experiencing a financial hardship that has you falling behind on your monthly payments.

by Optima Financial Group | Dec 11, 2012 | Tax Relief Solutions

Annually, the Internal Revenue Service (IRS) reaches out to taxpayers across America who earned $49,078 or less to offer a little tax relief by way of the Earned Income Tax Credit (EITC).

The EITC varies according to your income, family size and filing status. Basically, it is a federal refund for taxpayers with low to moderate incomes. And eligible taxpayers may still get a refund even if they don’t owe taxes.

Eligible workers often miss out on it because they either don’t claim it or don’t file a tax return. This is especially true if their financial situation has changed; something that has happened to a lot of Americans over the last few years.

You can easily find out if you qualify just by visiting IRS.gov and answering a few questions using the EITC Assistant.

To get your EITC refund, you have to:

- Have had earned income through employment, self-employment or farming

- Have a valid social security number

- Be a U.S. citizen or resident alien, or a non-resident alien married to a citizen or resident alien

- Be 25 years or older

- Have investment income of less than $3,150

- Not be claimed on someone else’s tax return

- File a tax return

There are additional stipulations with regard to how you file (single or married) and whether you have filed Form 2555 (foreign income). However, in this climate of continuing financial struggle, taking the time to determine if you are eligible for some tax relief from the IRS is well worth the time investment.

And if taxes aren’t the only financial obligation that has you struggling right now; if other unsecured debt like credit cards, student loans or a car note have you wondering how you will make ends meet, take the time to ask us about debt settlement. It’s our specialty.

by Optima Financial Group | Nov 13, 2012 | Tax Relief Solutions

The IRS brings good news this week to middle-class Americans who continue to struggle with tax debt by expanding their Fresh Start Initiative.

Loosened guidelines for the Offer in Compromise program, which forgives a portion of a taxpayer’s debt, will allow more Americans to qualify as well as eliminate their tax debt in as little as two years, compared with four or five years.

The adjustments to the program come after the IRS recognizes that many taxpayers are still struggling to pay their bills. They wanted to apply a common sense approach to reflect real-world scenarios.

Changes to the program include:

- Revising the method of calculating taxpayer’s future income.

- Flexibility in repaying student loans.

- Flexibility in paying local and state delinquent taxes

- Expanding the Allowable Living Expense allowance (expenses such as credit card payments and bank fees can now be taken into account).

The changes will allow many more consumers to qualify for tax relief under the Offer in Compromise program. Specifically, when the IRS calculates a taxpayer’s reasonable collection potential, it will now look at only one year of future income for offers paid in five or fewer months, down from four years, and two years of future income for offers paid in six to 24 months, down from five years.

“This phase of Fresh Start will assist some taxpayers who have faced the most financial hardships in recent years,” said IRS commissioner Doug Shulman. “It is part of our multi-year effort to help taxpayers who are struggling to make ends meet.”

The IRS, having a reputation of rigidity, surprised many Americans with this welcomed announcement of increased flexibility. Full details of the announcement are available at theIRS website.

by Optima Financial Group | Oct 5, 2012 | Tax Relief Solutions

A IRS tax levy is the toughest collection tool in the IRS arsenal. An IRS tax levy means that the government has the right to seize your property and assets in payment for unpaid tax debt. Unlike a lien, a tax levy actually gives the IRS the right to take and sell your property to settle your debt. If you have been issued a tax levy, don’t give up: you can still settle your tax debt.

There are several ways you can remove an IRS levy:

- Pay the tax debt in full. Once the debt is paid, the IRS will immediate halt the collection process. If you don’t have the funds available to pay the entire debt, options might include taking out a loan, borrowing money from friends or family, or refinancing your home. The IRS agent might be willing to put a temporary hold on collection procedures if you have a reasonable plan for coming up with the money.

- Set up a payment plan. This may be the simplest and easiest option. If you owe less than $25,000 in back taxes, the IRS will typically stop the tax levy once you have agreed to an IRS payment plan.

- Set up a partial payment plan. Similar to the installment plan, in a partial payment plan you will agree to pay the IRS what you owe over time. The main difference is that your payments will be smaller than with the installment plan and you must be able to prove that you don’t have the financial resources to make the payments required under the installment plan.

- Submit a compromise offer. If you submit an offer in compromise the IRS will automatically halt collection proceedings until the offer is reviewed. If the offer is accepted, you must pay the amount of the offer. If the offer is rejected, the IRS will resume collection proceedings unless you can set up a payment agreement.

- Prove that the levy is causing undue financial hardship. The conditions on this are stringent and the IRS is the final judge. If you can prove that the levy is making it difficult to provide for your families basic needs such as food and shelter, the IRS will lift the levy.

- Prove that the IRS is trying to collect on assets with no equity. If you can show the IRS that it’s not worth their effort to collect, the IRS may lift the levy. This would only apply in situations where you have little or no equity in your assets, such as a home with a mortgage large enough to offset the selling price.

- Let the statute of limitations expire. There is a 10 year statute of limitations on IRS tax debt. If the 10 year limit is drawing near, the IRS may try to extend the time limit by getting you to agree to a payment plan or other settlement. If you are on year nine of the ten year period however, you may be able to let the statute of limitations expire without payment.

The post How to Remove an IRS Levy appeared first on Debt America.